Sempra Reports First-Quarter 2023 Earnings Results

- Finalizes base rate review at Oncor

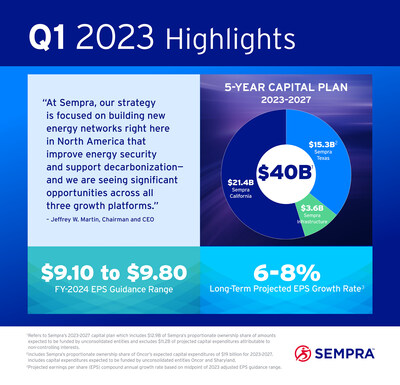

- Announces

$4 billion increase to Oncor's five-year capital plan - Updates Sempra's five-year capital plan to

$40 billion - Issues full-year 2024 EPS guidance range of

$9.10 to$9.80

"At Sempra, our strategy is focused on building new energy networks right here in

The reported financial results reflect certain significant items as described on an after-tax basis in the following table of GAAP (generally accepted accounting principles in

|

(Dollars and shares in millions, except EPS) |

Three months ended |

||||

|

2023 |

2022 |

||||

|

(Unaudited) |

|||||

|

GAAP Earnings |

$ 969 |

$ 612 |

|||

|

Impact associated with |

— |

66 |

|||

|

Equity losses from a write-off of rate base disallowances resulting from the PUCT's final order in |

44 |

— |

|||

|

Impact from foreign currency and inflation on our monetary positions in |

109 |

75 |

|||

|

Net unrealized (gains) losses on derivatives |

(217) |

51 |

|||

|

Net unrealized losses on a contingent interest rate swap related to the Port Arthur LNG Phase 1 |

17 |

— |

|||

|

Deferred income tax expense associated with the change in our indefinite reinvestment assertion |

— |

120 |

|||

|

Adjusted Earnings(1) |

$ 922 |

$ 924 |

|||

|

Diluted Weighted-Average Common Shares Outstanding |

316 |

317 |

|||

|

GAAP EPS |

$ 3.07 |

$ 1.93 |

|||

|

Adjusted EPS(1) |

$ 2.92 |

$ 2.91 |

|||

|

1) See Table A for information regarding non-GAAP financial measures and descriptions of adjustments. |

Earnings Guidance

Sempra is updating its full-year 2023 GAAP earnings per common share (EPS) guidance range of

Capital Investment Opportunities

Sempra sees robust opportunities for significant capital investments across all three growth platforms over the next five years, with a goal of improving safety, bolstering reliability and supporting the delivery of cleaner sources of energy. To capture these opportunities, the company is announcing a new five-year capital plan of

"This is an exciting time for our company. Continued strong execution across our three growth platforms, together with significant projected rate base growth, support our positive view of the earnings power of our business going forward," said

Sempra California

Throughout the quarter, SDGE and SoCalGas advanced strategic programs to modernize their energy networks and advance climate resiliency and access to cleaner energy. In March, SDGE achieved a major milestone in its

Together with

In April,

Subsequently, Oncor announced its five-year capital plan of

Oncor continues to advance critical transmission and distribution infrastructure projects to support population growth in

During the first quarter,

Notably,

Progress also continues at Energía Costa Azul LNG Phase 1 where construction at the project logged over six million hours worked with no lost time incidents and remains on track to reach commercial operations by summer of 2025.

Earlier this quarter, the Cameron LNG Phase 2 development project received approval from the

Non-GAAP Financial Measures

Non-GAAP financial measures include Sempra's adjusted earnings, adjusted EPS and adjusted EPS guidance range. See Table A for additional information regarding these non-GAAP financial measures.

Internet Broadcast

Sempra will broadcast a live discussion of its earnings results over the internet today at

About Sempra

Sempra is a leading North American energy infrastructure company that helps meet the daily energy needs of nearly 40 million consumers. As the owner of one of the largest energy networks on the continent, Sempra is helping to electrify and decarbonize some of the world's most significant economic markets, including

This press release contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on assumptions with respect to the future, involve risks and uncertainties, and are not guarantees. Future results may differ materially from those expressed or implied in any forward-looking statement. These forward-looking statements represent our estimates and assumptions only as of the date of this press release. We assume no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise.

In this press release, forward-looking statements can be identified by words such as "believes," "expects," "intends," "anticipates," "contemplates," "plans," "estimates," "projects," "forecasts," "should," "could," "would," "will," "confident," "may," "can," "potential," "possible," "proposed," "in process," "construct," "develop," "opportunity," "initiative," "target," "outlook," "optimistic," "poised," "maintain," "continue," "progress," "advance," "goal," "aim," "commit," or similar expressions, or when we discuss our guidance, priorities, strategy, goals, vision, mission, opportunities, projections, intentions or expectations.

Factors, among others, that could cause actual results and events to differ materially from those expressed or implied in any forward-looking statement include risks and uncertainties relating to:

These risks and uncertainties are further discussed in the reports that Sempra has filed with the

None of the website references in this press release are active hyperlinks, and the information contained on, or that can be accessed through, any such website is not, and shall not be deemed to be, part of this document.

|

|

|||||||||||

|

Table A |

|||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|||||||||||

|

(Dollars in millions, except per share amounts; shares in thousands) |

|||||||||||

|

Three months ended |

|||||||||||

|

2023 |

2022 |

||||||||||

|

(unaudited) |

|||||||||||

|

REVENUES |

|||||||||||

|

Utilities: |

|||||||||||

|

Natural gas |

$ |

4,412 |

$ |

2,320 |

|||||||

|

Electric |

1,027 |

1,117 |

|||||||||

|

Energy-related businesses |

1,121 |

383 |

|||||||||

|

Total revenues |

6,560 |

3,820 |

|||||||||

|

EXPENSES AND OTHER INCOME |

|||||||||||

|

Utilities: |

|||||||||||

|

Cost of natural gas |

(2,683) |

(802) |

|||||||||

|

Cost of electric fuel and purchased power |

(114) |

(205) |

|||||||||

|

Energy-related businesses cost of sales |

(193) |

(135) |

|||||||||

|

Operation and maintenance |

(1,209) |

(1,086) |

|||||||||

|

|

— |

(92) |

|||||||||

|

Depreciation and amortization |

(539) |

(493) |

|||||||||

|

Franchise fees and other taxes |

(192) |

(162) |

|||||||||

|

Other income, net |

41 |

38 |

|||||||||

|

Interest income |

24 |

25 |

|||||||||

|

Interest expense |

(366) |

(243) |

|||||||||

|

Income before income taxes and equity earnings |

1,329 |

665 |

|||||||||

|

Income tax expense |

(376) |

(334) |

|||||||||

|

Equity earnings |

219 |

326 |

|||||||||

|

Net income |

1,172 |

657 |

|||||||||

|

Earnings attributable to noncontrolling interests |

(192) |

(34) |

|||||||||

|

Preferred dividends |

(11) |

(11) |

|||||||||

|

Earnings attributable to common shares |

$ |

969 |

$ |

612 |

|||||||

|

Basic earnings per common share (EPS): |

|||||||||||

|

Earnings |

$ |

3.08 |

$ |

1.93 |

|||||||

|

Weighted-average common shares outstanding |

314,919 |

316,353 |

|||||||||

|

Diluted EPS: |

|||||||||||

|

Earnings |

$ |

3.07 |

$ |

1.93 |

|||||||

|

Weighted-average common shares outstanding |

316,124 |

317,434 |

|||||||||

Table A (Continued)

RECONCILIATION OF SEMPRA ADJUSTED EARNINGS TO SEMPRA GAAP EARNINGS (Unaudited)

Sempra Adjusted Earnings and Adjusted EPS exclude items (after the effects of income taxes and, if applicable, noncontrolling interests (NCI)) in 2023 and 2022 as follows:

Three months ended

$(44) million equity losses from investment inOncor Electric Delivery Holdings Company LLC (Oncor Holdings ) related to a write-off of rate base disallowances resulting from thePublic Utility Commission of Texas' (PUCT) final order inOncor Electric Delivery Company LLC's (Oncor) comprehensive base rate review$(109) million impact from foreign currency and inflation on our monetary positions inMexico $217 million net unrealized gains on commodity derivatives$(17) million net unrealized losses on a contingent interest rate swap related to the initial phase of the Port Arthur LNG liquefaction project (PA LNG Phase 1 project)

Three months ended

$(66) million impact associated withAliso Canyon natural gas storage facility litigation atSouthern California Gas Company (SoCalGas)$(75) million impact from foreign currency and inflation on our monetary positions inMexico $(51) million net unrealized losses on commodity derivatives$(120) million deferred income tax expense associated with the change in our indefinite reinvestment assertion as a result of progress in obtaining regulatory approvals necessary to close the sale of 10% NCI inSempra Infrastructure Partners, LP (SI Partners ) toAbu Dhabi Investment Authority (ADIA)

Sempra Adjusted Earnings and Adjusted EPS are non-GAAP financial measures (GAAP represents generally accepted accounting principles in

|

RECONCILIATION OF ADJUSTED EARNINGS TO GAAP EARNINGS |

|||||||||||||||||||||||||||||||||||

|

(Dollars in millions, except EPS; shares in thousands) |

|||||||||||||||||||||||||||||||||||

|

Pretax amount |

Income tax expense (benefit)(1) |

Non-controlling interests |

Earnings |

Pretax amount |

Income tax (benefit) expense(1) |

Non-controlling interests |

Earnings |

||||||||||||||||||||||||||||

|

Three months ended |

Three months ended |

||||||||||||||||||||||||||||||||||

|

(unaudited) |

|||||||||||||||||||||||||||||||||||

|

Sempra GAAP Earnings |

$ |

969 |

$ |

612 |

|||||||||||||||||||||||||||||||

|

Excluded items: |

|||||||||||||||||||||||||||||||||||

|

Impact associated with |

$ |

— |

$ |

— |

$ |

— |

— |

$ |

92 |

$ |

(26) |

$ |

— |

66 |

|||||||||||||||||||||

|

Equity losses from a write-off of rate base disallowances resulting from the PUCT's final order in Oncor's comprehensive base rate review |

— |

— |

— |

44 |

— |

— |

— |

— |

|||||||||||||||||||||||||||

|

Impact from foreign currency and inflation on our monetary positions in |

25 |

135 |

(51) |

109 |

25 |

70 |

(20) |

75 |

|||||||||||||||||||||||||||

|

Net unrealized (gains) losses on commodity derivatives |

(428) |

85 |

126 |

(217) |

88 |

(20) |

(17) |

51 |

|||||||||||||||||||||||||||

|

Net unrealized losses on a contingent interest rate swap related to the PA LNG Phase 1 project |

33 |

(6) |

(10) |

17 |

— |

— |

— |

— |

|||||||||||||||||||||||||||

|

Deferred income tax expense associated with the change in our indefinite reinvestment assertion related to the sale of NCI to ADIA |

— |

— |

— |

— |

— |

120 |

— |

120 |

|||||||||||||||||||||||||||

|

Sempra Adjusted Earnings |

$ |

922 |

$ |

924 |

|||||||||||||||||||||||||||||||

|

Diluted EPS: |

|||||||||||||||||||||||||||||||||||

|

Weighted-average common shares outstanding, diluted |

316,124 |

317,434 |

|||||||||||||||||||||||||||||||||

|

Sempra GAAP EPS |

$ |

3.07 |

$ |

1.93 |

|||||||||||||||||||||||||||||||

|

Sempra Adjusted EPS |

$ |

2.92 |

$ |

2.91 |

|||||||||||||||||||||||||||||||

|

(1) |

Except for adjustments that are solely income tax, income taxes on pretax amounts were primarily calculated based on applicable statutory tax rates. We record equity losses for our investment in |

Table A (Continued)

RECONCILIATION OF SEMPRA 2023 ADJUSTED EPS GUIDANCE RANGE TO SEMPRA 2023 GAAP EPS GUIDANCE RANGE (Unaudited)

Sempra 2023

$(44) million equity losses from investment inOncor Holdings related to a write-off of rate base disallowances resulting from the PUCT's final order in Oncor's comprehensive base rate review$(109) million impact from foreign currency and inflation on our monetary positions inMexico $217 million net unrealized gains on commodity derivatives$(17) million net unrealized losses on a contingent interest rate swap related to the PA LNG Phase 1 project

Sempra 2023 Adjusted EPS Guidance is a non-GAAP financial measure. This non-GAAP financial measure excludes significant items that are generally not related to our ongoing business activities and/or infrequent in nature. This non-GAAP financial measure also excludes the impact from foreign currency and inflation effects on our monetary positions in

|

RECONCILIATION OF ADJUSTED EPS GUIDANCE RANGE TO GAAP EPS GUIDANCE RANGE |

|||||||||||

|

Full-Year 2023 |

|||||||||||

|

|

$ |

8.76 |

to |

$ |

9.36 |

||||||

|

Excluded items: |

|||||||||||

|

Equity losses from a write-off of rate base disallowances resulting from the PUCT's final order in Oncor's comprehensive base rate review |

0.14 |

0.14 |

|||||||||

|

Impact from foreign currency and inflation on our monetary positions in |

0.34 |

0.34 |

|||||||||

|

Net unrealized gains on commodity derivatives |

(0.69) |

(0.69) |

|||||||||

|

Net unrealized losses on a contingent interest rate swap related to the PA LNG Phase 1 project |

0.05 |

0.05 |

|||||||||

|

|

$ |

8.60 |

to |

$ |

9.20 |

||||||

|

Weighted-average common shares outstanding, diluted (millions) |

316 |

||||||||||

|

|

|||||||||||

|

Table B |

|||||||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|||||||||||

|

(Dollars in millions) |

|||||||||||

|

|

|

||||||||||

|

(unaudited) |

|||||||||||

|

ASSETS |

|||||||||||

|

Current assets: |

|||||||||||

|

Cash and cash equivalents |

$ |

534 |

$ |

370 |

|||||||

|

Restricted cash |

85 |

40 |

|||||||||

|

Accounts receivable – trade, net |

2,581 |

2,635 |

|||||||||

|

Accounts receivable – other, net |

498 |

685 |

|||||||||

|

Due from unconsolidated affiliates |

74 |

54 |

|||||||||

|

Income taxes receivable |

79 |

113 |

|||||||||

|

Inventories |

315 |

403 |

|||||||||

|

Prepaid expenses |

255 |

268 |

|||||||||

|

Regulatory assets |

115 |

351 |

|||||||||

|

Fixed-price contracts and other derivatives |

460 |

803 |

|||||||||

|

Greenhouse gas allowances |

143 |

141 |

|||||||||

|

Other current assets |

65 |

49 |

|||||||||

|

Total current assets |

5,204 |

5,912 |

|||||||||

|

Other assets: |

|||||||||||

|

Restricted cash |

84 |

52 |

|||||||||

|

Regulatory assets |

2,935 |

2,588 |

|||||||||

|

Greenhouse gas allowances |

907 |

796 |

|||||||||

|

Nuclear decommissioning trusts |

864 |

841 |

|||||||||

|

Dedicated assets in support of certain benefit plans |

511 |

505 |

|||||||||

|

Deferred income taxes |

148 |

135 |

|||||||||

|

Right-of-use assets – operating leases |

639 |

655 |

|||||||||

|

Investment in |

13,735 |

13,665 |

|||||||||

|

Other investments |

2,001 |

2,012 |

|||||||||

|

|

1,602 |

1,602 |

|||||||||

|

Other intangible assets |

337 |

344 |

|||||||||

|

Wildfire fund |

295 |

303 |

|||||||||

|

Other long-term assets |

1,482 |

1,382 |

|||||||||

|

Total other assets |

25,540 |

24,880 |

|||||||||

|

Property, plant and equipment, net |

49,805 |

47,782 |

|||||||||

|

Total assets |

$ |

80,549 |

$ |

78,574 |

|||||||

|

(1) Derived from audited financial statements. |

|

|

|||||||||||

|

Table B (Continued) |

|||||||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS (CONTINUED) |

|||||||||||

|

(Dollars in millions) |

|||||||||||

|

|

|

||||||||||

|

(unaudited) |

|||||||||||

|

LIABILITIES AND EQUITY |

|||||||||||

|

Current liabilities: |

|||||||||||

|

Short-term debt |

$ |

3,037 |

$ |

3,352 |

|||||||

|

Accounts payable – trade |

2,122 |

1,994 |

|||||||||

|

Accounts payable – other |

283 |

275 |

|||||||||

|

Due to unconsolidated affiliates |

41 |

— |

|||||||||

|

Dividends and interest payable |

667 |

621 |

|||||||||

|

Accrued compensation and benefits |

344 |

484 |

|||||||||

|

Regulatory liabilities |

427 |

504 |

|||||||||

|

Current portion of long-term debt and finance leases |

1,220 |

1,019 |

|||||||||

|

Reserve for |

129 |

129 |

|||||||||

|

Greenhouse gas obligations |

143 |

141 |

|||||||||

|

Other current liabilities |

1,217 |

1,380 |

|||||||||

|

Total current liabilities |

9,630 |

9,899 |

|||||||||

|

Long-term debt and finance leases |

25,206 |

24,548 |

|||||||||

|

Deferred credits and other liabilities: |

|||||||||||

|

Due to unconsolidated affiliates |

278 |

301 |

|||||||||

|

Regulatory liabilities |

3,408 |

3,341 |

|||||||||

|

Greenhouse gas obligations |

650 |

565 |

|||||||||

|

Pension and other postretirement benefit plan obligations, net of plan assets |

378 |

410 |

|||||||||

|

Deferred income taxes |

4,938 |

4,591 |

|||||||||

|

Asset retirement obligations |

3,564 |

3,546 |

|||||||||

|

Deferred credits and other |

2,252 |

2,117 |

|||||||||

|

Total deferred credits and other liabilities |

15,468 |

14,871 |

|||||||||

|

Equity: |

|||||||||||

|

|

27,667 |

27,115 |

|||||||||

|

Preferred stock of subsidiary |

20 |

20 |

|||||||||

|

Other noncontrolling interests |

2,558 |

2,121 |

|||||||||

|

Total equity |

30,245 |

29,256 |

|||||||||

|

Total liabilities and equity |

$ |

80,549 |

$ |

78,574 |

|||||||

|

(1) Derived from audited financial statements. |

|

|

|

|||||||||||

|

Table C |

|||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|||||||||||

|

(Dollars in millions) |

|||||||||||

|

Three months ended |

|||||||||||

|

2023 |

2022 |

||||||||||

|

(unaudited) |

|||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|||||||||||

|

Net income |

$ |

1,172 |

$ |

657 |

|||||||

|

Adjustments to reconcile net income to net cash provided by operating activities |

357 |

705 |

|||||||||

|

Net change in working capital components |

451 |

326 |

|||||||||

|

Distributions from investments |

199 |

204 |

|||||||||

|

Changes in other noncurrent assets and liabilities, net |

(199) |

(285) |

|||||||||

|

Net cash provided by operating activities |

1,980 |

1,607 |

|||||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|||||||||||

|

Expenditures for property, plant and equipment |

(1,830) |

(1,204) |

|||||||||

|

Expenditures for investments |

(85) |

(85) |

|||||||||

|

Purchases of nuclear decommissioning and other trust assets |

(181) |

(242) |

|||||||||

|

Proceeds from sales of nuclear decommissioning and other trust assets |

199 |

242 |

|||||||||

|

Other |

2 |

(1) |

|||||||||

|

Net cash used in investing activities |

(1,895) |

(1,290) |

|||||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|||||||||||

|

Common dividends paid |

(360) |

(349) |

|||||||||

|

Issuances of common stock |

— |

3 |

|||||||||

|

Repurchases of common stock |

(31) |

(226) |

|||||||||

|

Issuances of debt (maturities greater than 90 days) |

1,986 |

4,023 |

|||||||||

|

Payments on debt (maturities greater than 90 days) and finance leases |

(1,803) |

(1,048) |

|||||||||

|

Increase (decrease) in short-term debt, net |

168 |

(720) |

|||||||||

|

Advances from unconsolidated affiliates |

14 |

18 |

|||||||||

|

Proceeds from sales of noncontrolling interests |

265 |

13 |

|||||||||

|

Distributions to noncontrolling interests |

(43) |

(53) |

|||||||||

|

Contributions from noncontrolling interests |

97 |

6 |

|||||||||

|

Settlement of cross-currency swaps |

(99) |

— |

|||||||||

|

Other |

(43) |

(29) |

|||||||||

|

Net cash provided by financing activities |

151 |

1,638 |

|||||||||

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

5 |

— |

|||||||||

|

Increase in cash, cash equivalents and restricted cash |

241 |

1,955 |

|||||||||

|

Cash, cash equivalents and restricted cash, |

462 |

581 |

|||||||||

|

Cash, cash equivalents and restricted cash, |

$ |

703 |

$ |

2,536 |

|||||||

|

|

|||||||||||

|

Table D |

|||||||||||

|

SEGMENT EARNINGS (LOSSES) AND CAPITAL EXPENDITURES AND INVESTMENTS |

|||||||||||

|

(Dollars in millions) |

|||||||||||

|

Three months ended |

|||||||||||

|

2023 |

2022 |

||||||||||

|

(unaudited) |

|||||||||||

|

Earnings (Losses) Attributable to Common Shares |

|||||||||||

|

SDG&E |

$ |

258 |

$ |

234 |

|||||||

|

SoCalGas |

360 |

334 |

|||||||||

|

|

83 |

162 |

|||||||||

|

|

315 |

95 |

|||||||||

|

Parent and other |

(47) |

(213) |

|||||||||

|

Total |

$ |

969 |

$ |

612 |

|||||||

|

Three months ended |

|||||||||||

|

2023 |

2022 |

||||||||||

|

(unaudited) |

|||||||||||

|

Capital Expenditures and Investments |

|||||||||||

|

SDG&E |

$ |

624 |

$ |

552 |

|||||||

|

SoCalGas |

458 |

468 |

|||||||||

|

|

85 |

85 |

|||||||||

|

|

744 |

182 |

|||||||||

|

Parent and other |

4 |

2 |

|||||||||

|

Total |

$ |

1,915 |

$ |

1,289 |

|||||||

|

|

||||||||||||||

|

Table E |

||||||||||||||

|

OTHER OPERATING STATISTICS |

||||||||||||||

|

Three months ended |

||||||||||||||

|

2023 |

2022 |

|||||||||||||

|

(unaudited) |

||||||||||||||

|

UTILITIES |

||||||||||||||

|

SDG&E and SoCalGas |

||||||||||||||

|

Gas sales (Bcf)(1) |

145 |

116 |

||||||||||||

|

Transportation (Bcf)(1) |

149 |

144 |

||||||||||||

|

Total deliveries (Bcf)(1) |

294 |

260 |

||||||||||||

|

Total gas customer meters (thousands) |

7,049 |

7,013 |

||||||||||||

|

SDG&E |

||||||||||||||

|

Electric sales (millions of kWhs)(1) |

1,596 |

2,266 |

||||||||||||

|

Community Choice Aggregation and Direct Access (millions of kWhs)(2) |

2,732 |

1,898 |

||||||||||||

|

Total deliveries (millions of kWhs)(1) |

4,328 |

4,164 |

||||||||||||

|

Total electric customer meters (thousands) |

1,507 |

1,498 |

||||||||||||

|

Oncor(3) |

||||||||||||||

|

Total deliveries (millions of kWhs) |

34,779 |

33,711 |

||||||||||||

|

Total electric customer meters (thousands) |

3,912 |

3,848 |

||||||||||||

|

Ecogas |

||||||||||||||

|

Natural gas sales (Bcf) |

1 |

1 |

||||||||||||

|

Natural gas customer meters (thousands) |

152 |

144 |

||||||||||||

|

ENERGY-RELATED BUSINESSES |

||||||||||||||

|

|

||||||||||||||

|

Termoeléctrica de |

569 |

524 |

||||||||||||

|

Wind and solar (millions of kWhs)(1) |

812 |

732 |

||||||||||||

|

(1) |

Includes intercompany sales. |

|

(2) |

Several jurisdictions in SDG&E's territory have implemented Community Choice Aggregation, including the |

|

(3) |

Includes 100% of the electric deliveries and customer meters of Oncor, in which we hold an indirect 80.25% |

|

SEMPRA ENERGY |

|||||||||||||||||||||||||||||||||||||||

|

Table F (Unaudited) |

|||||||||||||||||||||||||||||||||||||||

|

STATEMENTS OF OPERATIONS DATA BY SEGMENT |

|||||||||||||||||||||||||||||||||||||||

|

(Dollars in millions) |

|||||||||||||||||||||||||||||||||||||||

|

Three months ended |

SDG&E |

SoCalGas |

Utilities |

Sempra Infrastructure |

Consolidating Adjustments, Parent & Other |

Total |

|||||||||||||||||||||||||||||||||

|

Revenues |

$ |

1,653 |

$ |

3,794 |

$ |

— |

$ |

1,196 |

$ |

(83) |

$ |

6,560 |

|||||||||||||||||||||||||||

|

Cost of sales and other expenses |

(1,037) |

(3,061) |

(1) |

(355) |

63 |

(4,391) |

|||||||||||||||||||||||||||||||||

|

Depreciation and amortization |

(262) |

(206) |

— |

(69) |

(2) |

(539) |

|||||||||||||||||||||||||||||||||

|

Other income (expense), net |

28 |

(8) |

— |

10 |

11 |

41 |

|||||||||||||||||||||||||||||||||

|

Income (loss) before interest and tax(1) |

382 |

519 |

(1) |

782 |

(11) |

1,671 |

|||||||||||||||||||||||||||||||||

|

Net interest expense |

(117) |

(65) |

— |

(80) |

(80) |

(342) |

|||||||||||||||||||||||||||||||||

|

Income tax (expense) benefit |

(7) |

(94) |

— |

(330) |

55 |

(376) |

|||||||||||||||||||||||||||||||||

|

Equity earnings |

— |

— |

84 |

135 |

— |

219 |

|||||||||||||||||||||||||||||||||

|

Earnings attributable to noncontrolling interests |

— |

— |

— |

(192) |

— |

(192) |

|||||||||||||||||||||||||||||||||

|

Preferred dividends |

— |

— |

— |

— |

(11) |

(11) |

|||||||||||||||||||||||||||||||||

|

Earnings (losses) attributable to common shares |

$ |

258 |

$ |

360 |

$ |

83 |

$ |

315 |

$ |

(47) |

$ |

969 |

|||||||||||||||||||||||||||

|

Three months ended |

SDG&E |

SoCalGas |

Utilities |

Sempra Infrastructure |

Consolidating Adjustments, Parent & Other |

Total |

|||||||||||||||||||||||||||||||||

|

Revenues |

$ |

1,445 |

$ |

1,993 |

$ |

— |

$ |

424 |

$ |

(42) |

$ |

3,820 |

|||||||||||||||||||||||||||

|

Cost of sales and other expenses |

(836) |

(1,290) |

(2) |

(279) |

17 |

(2,390) |

|||||||||||||||||||||||||||||||||

|

|

— |

(92) |

— |

— |

— |

(92) |

|||||||||||||||||||||||||||||||||

|

Depreciation and amortization |

(239) |

(187) |

— |

(65) |

(2) |

(493) |

|||||||||||||||||||||||||||||||||

|

Other income (expense), net |

34 |

34 |

— |

(16) |

(14) |

38 |

|||||||||||||||||||||||||||||||||

|

Income (loss) before interest and tax(1) |

404 |

458 |

(2) |

64 |

(41) |

883 |

|||||||||||||||||||||||||||||||||

|

Net interest expense |

(106) |

(40) |

— |

(6) |

(66) |

(218) |

|||||||||||||||||||||||||||||||||

|

Income tax expense |

(64) |

(84) |

— |

(91) |

(95) |

(334) |

|||||||||||||||||||||||||||||||||

|

Equity earnings, net |

— |

— |

164 |

162 |

— |

326 |

|||||||||||||||||||||||||||||||||

|

Earnings attributable to noncontrolling interests |

— |

— |

— |

(34) |

— |

(34) |

|||||||||||||||||||||||||||||||||

|

Preferred dividends |

— |

— |

— |

— |

(11) |

(11) |

|||||||||||||||||||||||||||||||||

|

Earnings (losses) attributable to common shares |

$ |

234 |

$ |

334 |

$ |

162 |

$ |

95 |

$ |

(213) |

$ |

612 |

|||||||||||||||||||||||||||

|

(1) |

Management believes Income (Loss) Before Interest and Tax is a useful measurement of our segments' performance because it can be used |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sempra-reports-first-quarter-2023-earnings-results-301815574.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sempra-reports-first-quarter-2023-earnings-results-301815574.html

SOURCE Sempra

Media: Patricia Kakridas, Sempra, (877) 340-8875, media@sempra.com; Financial: Jenell McKay, Sempra, (877) 736-7727, investor@sempra.com